-

Home / Mt. Gox and Bitcoin users: remember, remember the 3rd of October (2008)

Was this valuable to you?

other links and editorials from digdug

Back in 2008, a law was enacted of which, even the name itself, sounded like it was straight out of an Ayn Rand novel. Legally, it's known as the Emergency Economic Stabilization Act of 2008.

You've heard of it. You know it as the US bank bailout.

It's been more than a few years, so let me refresh your memory with a summary of the story. Once upon a time, banks made a lot of very poor decisions when lending out a bunch of money. Many of those borrowers made a lot of very poor decisions to buy or build real estate. When the borrowers couldn't repay their loans, the loans went bad and the banks lost a tremendous amount of money. The poor banks were about to go out of business. It was called a financial meltdown.

At this point in our story, along comes a spider. Sorry, correction. Along comes a spider... Wrong again. Now I've got it. Along comes a spider: "Fed Chairman Ben Bernanke says that newly revealed details about the Fed's bank bailout were kept secret to prevent a stigma against banks that took part." Talk about frightening.

How much did the bank bailout cost? Who the hell knows. There are arguments made that the government earned taxpayers a profit of $12.5 billion, to it cost taxpayers $3.3 trillion not including additional backstops of $16.9 trillion, to it cost $23.7 trillion. Can we trust the government's numbers? Let's ask James Clapper.

A footnote to this drama concerns the insurance fund the banks (er, government... er, banks) already had. (Hey Mark Twain, do I repeat myself?) The Federal Deposit Insurance Corporation is actually supposed to be the organization who steps into the fray and protects the financial system from poor bank management decisions that cause meltdowns. (Like how I continue to use the term "poor" whenever I speak of "banks?") Yet the FDIC wasn't the agency who rescued the banks. Why? It wasn't big enough to support the "too big to fail" banks. No one ever conceived of a failure this large. That's how destructive their decisions were. The losses were beyond imagination, much less insurance reserves.

Free market, capitalistic society my ass. Cronyism isn't capitalism.

The bankers left an enormous mess. The government decides that the current and future generations should clean it up. How thoughtful. And banks are now, once again, incredibly profitable with record earnings. Imagine that. Incredible.

The dust of the bailout has since settled. People are no longer enraged. They're either too busy hunting for jobs to make ends meet or they just plain forgot why they're so broke. That's the great thing about history. It's in the past. Ho hum. How about those Olympics, huh? I'm really excited: baseball season is almost upon us.

What does this have to do with Bitcoins? Everything.

You see, if it weren't for what happened on October 3, 2008, major banks would have (and, arguably, should have) gone bankrupt. Instead, the government bailed them out to prevent a massive going out of business sale. Not surprisingly, "the government forced BB&T and some other healthy banks to accept TARP money to obscure that they were simply trying to save several large banks." (Obviously, banks who didn't take the money would have a much better reputation when the smoke cleared. We couldn't have anyone's reputation tarnished. No, no, no.)

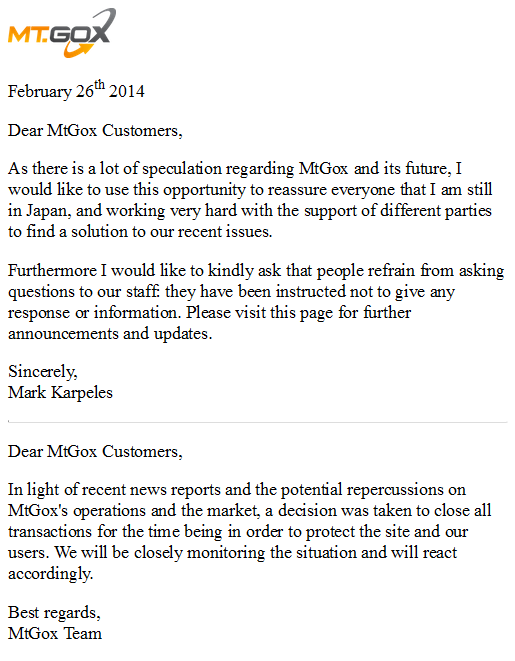

Mt. Gox, previously one of the largest Bitcoin marketplaces, is in crisis mode. Rumor has it they've been robbed of about 800,000 Bitcoins which, at current exchange rates, roughly translates to about $500 million lost. Their purported crisis strategy document proffers warnings that, if they go down, so does Bitcoin. Yet Mt. Gox's business plan sure did look good.

Where's the FDIC when we need them? Where's our TARP money? Where's our bailout? Bitcoin needs a rescue plan, quick!

Or not.

Let's face it: no one is going to come to the rescue. Mt. Gox is going to fail. (Correction: has failed.) They are going to go out of business. People who had money on deposit are going to lose it. All of it. It's so terrible.

But this too shall pass. I don't expect Bitcoin to be destroyed. I don't expect cryptocurrencies to become avoided. If anything, I expect the Bitcoin marketplace to become stronger. To paraphrase c_prompt, the Bitcoin community will come together as one voice and act appropriately. This is one of the greatnesses of humanity. Why will they? Because many in the Bitcoin community support Bitcoin for more than just the money to be made. There is philosophy behind Bitcoin.

Bitcoin isn't going to get a bailout from the government. If anything, and unlike the banks, the government will likely seek to prosecute participants in the Mt. Gox meltdown. As you read about the coming criminal prosecutions, try to remember that "not one banker has gone to jail for anything that led to the great financial meltdown of 2008-2009."

Not one.

Think about that as you busily prepare your tax returns over the next month. While you're doing so, the government and bank executives will be laughing... all the way to the bank.

Their bank. Not yours.

This work, excluding any content linked via another source/website, is licensed under a Creative Commons Attribution 4.0 United States License. Permission to reprint in whole or in part is gladly granted, provided full credit is given and references the URL: http:/

This work, excluding any content linked via another source/website, is licensed under a Creative Commons Attribution 4.0 United States License. Permission to reprint in whole or in part is gladly granted, provided full credit is given and references the URL: http:/About bitcoin

Bitcoin is a peer-to-peer payment system and digital currency introduced as open source software in 2009 by pseudonymous developer Satoshi Nakamoto. It is a cryptocurrency, so-called because it uses cryptography to control the creation and transfer of money. Conventionally, the capitalized word "Bitcoin" refers to the technology and network, whereas lowercase "bitcoins" refers to the currency itself.

Bitcoins are created by a process called mining, in which participants verify and record payments in exchange for transaction fees and newly minted bitcoins. Users send and receive bitcoins using wallet software on a personal computer, mobile device, or a web application. Bitcoins can be obtained by mining or in exchange for products, services, or other currencies.