-

Home / The Morality of Bitcoin (Or Why One Libertarian Has It All Wrong)

Was this valuable to you?

other links and editorials from digdug

I've a bone to pick with a libertarian. Possibly more than one, but not everyone. At the moment, my focus is this one (who also penned this and this and this). Surely, Gary North's ax is sharp as a samurai sword with so much grinding.

Mr. North is a well-known and respected libertarian and economic expert (if you run in those circles). For people who desire freedom (a term I use exclusively in the political sense), what he says is important to ponder. Such reflection has led me to three conclusions: 1) his understanding of bitcoin is minuscule; 2) he is contradicting some of his own principles by denouncing bitcoin, and; 3) he is blatantly ignoring his own field of theoretical science - Austrian economics - and, more specifically, praxeology, the logic of action and the science of means. Although irrelevant, these conclusions lead me to suspect he is intentionally putting his erudition aside because it conflicts with his worldview.

To substantiate my conclusions, I'm not going to discuss bitcoin's technical aspects, its potential benefits, or why it matters. There are people far more capable to present the likes of transferring digital property more securely, decentralized trust, etc. He won't care about those anyway.

Mr. North is waiting for "a detailed defense of Bitcoins from an Austrian school economist or economic historian." I am neither. But such credentials are not required for a proper defense. We can simply use his Austrian school premises. As he is fond of Ludwig von Mises, Human Action (HA) seems an appropriate reference to debunk what he claims are decisive economic principles concerning bitcoin's demise. I will reference it often and try not to duplicate where Austrian economists already have refuted Mr. North.

As an aside, that's one of the great things about Mises: although the reading is rather dry (I imagine more so if you're not interested in the subject matter), the messages and support logic are very clear and easily understood.

Mr. North has written extensively on bitcoin and, although I expect I could, I choose not to address the problem with every argument in every screed. There are too many. Candidly, the more I read, the more bizarre they became. So I will be selective. But, before questioning some of the contradictions and double-standards with his arguments, I want to address a critical topic that I think is missing from all bitcoin debate, especially Mr. North's...

Philosophy.

Bitcoin is amoral. It's not human. It's an electron on a silicon wafer. It's an object. Like a shoe. A shoe can be used for good (so I don't cut myself on rocks) or bad (if I hit you in the face with it). There are advantages to using a shoe, just as there are disadvantages (wearing one while walking on the beach prevents me from enjoying the warm sand between my toes).

Bitcoin is amoral because morality is a human construct that applies logic to the choices we make of our own free will. Thus, morality only applies to humans and, more specifically, their voluntary actions. Morality does not apply where free will does not exist.

Bitcoin can be used for good or bad, and it has advantages and disadvantages. To debate these are not my intent. Mr. North is correct that some of the claimed benefits (e.g., privacy) may not be as beneficial as the competition (e.g., paper money) in certain circumstances (e.g., paper money privacy goes out the window when you're dealing with over $10,000). If Mr. North had stuck to the benefits and limitations of using bitcoin to achieve a particular end, I'd be doing something else right now. History is full of heroes and their naysayers.

However, Mr. North made the absurd claim that bitcoin is not money and predicted bitcoin will never be the money of the future. It appears his views are restricted to buying and selling material goods painted against the offset of a historical canvas. I found this narrow perspective surprising from an Austrian economist who should know that economics is more about free will choices and actions than commodities and history. Mises likely would have said his "theory of value was defective." (HA, 2) Here is what Mises did say:

"The general theory of choice and preference goes far beyond the horizon which encompassed the scope of economic problems as circumscribed by the economists from Cantillon, Hume, and Adam Smith down to John Stuart Mill. It is much more than merely a theory of the "economic side" of human endeavors and of man's striving for commodities and an improvement in his material well-being. It is the science of every kind of human action. Choosing determines all human decisions. In making his choice man chooses not only between various material things and services. All human values are offered for option. All ends and all means, both material and ideal issues, the sublime and the base, the noble and the ignoble, are ranged in a single row and subjected to a decision which picks out one thing and sets aside another. Nothing that men aim at or want to avoid remains outside of this arrangement into a unique scale of gradation and preference. The modern theory of value widens the scientific horizon and enlarges the field of economic studies. Out of the political economy of the classical school emerges the general theory of human action, praxeology." (HA, 3)

Mr. North's narrow views also strike me as odd coming from someone who is clearly a very spiritual/religious person. Has it not occurred to him that some of us are investing in bitcoin for what might be considered non-material goods or, more appropriately, "spiritual" ends? Is money only good as a token of exchange, or does it represent something more?

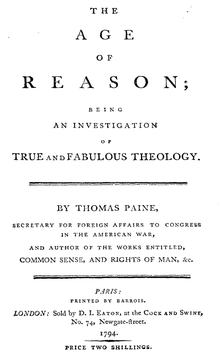

Thomas Paine wrote in the Age of Reason: "Man cannot make principles, he can only discover them." He was certainly a man who studied and understood history. As he knew from his study of history, freedom - one of his principles - has always been bought with blood.

From my point of view, something doesn't get more expensive. Among those who die in its pursuit, some believe it is worth the price. They invest their own blood in hopes of a potential return for their posterity. For an ideal. For a principle. It's a risky investment. Their currency - a foundational substance that makes the rest of their being possible - usually develops from a market exchange. The typical currencies of that previous exchange? Passion. Love. Desire. Beauty. Intelligence. Integrity. Achievement.

Not a bit, byte, wood pulp fiber, or discussion of atomic mass and melting point in one of those money substitutes. So what are the market participants exchanging if not fiat money or hard currency? Values.

Perhaps, then, it is fitting an exchange of blood is used to purchase and gain what they consider an even greater value.

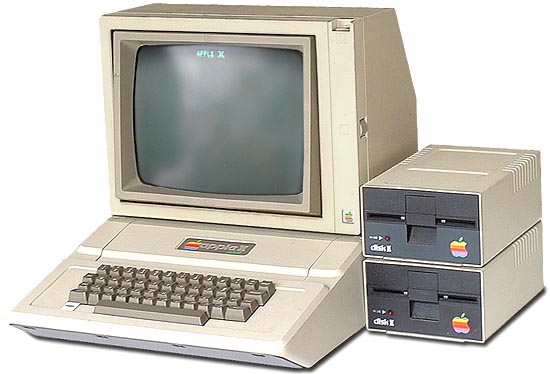

If Mr. North wants to buy a computer, a computer store will not provide one in exchange for every article he's ever written. Computer stores don't accept articles in exchange for computers. They only accept fiat currencies. If Mr. North wants that computer, he will exchange his articles with someone who will trade fiat currency.

In other words, to achieve the end he seeks, he must act and acquire the appropriate medium of exchange.

As an economist, Mr. North is interested in production, distribution, consumption, and management of goods and services. If he is of the opinion that bitcoin cannot competitively make any real difference against the central bank monopoly on money, it's certainly a reasonable prediction to make. My crystal ball has plenty of cracks from being dropped so often. It is often unreliable. Although Mises wrote that "[o]mniscience is denied to man" (HA, 7), perhaps his is in better shape.

I can predict the sun will rise tomorrow. I would have plenty of historical evidence to back up that prediction. It's very likely I'll be right. But, if the world or the sun were destroyed before tomorrow - history be damned - the accuracy of my prediction would be zero. More to the point, the accuracy of my prediction wouldn't be important. I'd be dead. So would the rest of us. It should go without saying that, if we're all dead, values don't matter.

In other words, if your immediate goal is to acquire computers or fiat currencies, Mr. North's advice might be sound in that there are better and even easier alternatives currently available. If your goal is privacy on a small, local scale, ditto.

But what if your values - and, thus, goals - are otherwise? What if values matter? What if your goal is to invest in the future of human production, distribution, and consumption, but only with honest productivity and good will? What if your goal is to live with integrity to your values? What if your goal is to work toward and contribute to a future where blood doesn't have to be the currency of freedom? What if your goal is to own a currency that has limited susceptibility to governmental theft (e.g., what economists sometimes call inflation)? As an economist Mr. North, is that your purview? Mises didn't appear to think so:

"It is true that economics is a theoretical science and as such abstains from any judgment of value. It is not its task to tell people what ends they should aim at. It is a science of the means to be applied for the attainment of ends chosen, not, to be sure, a science of the choosing of ends. Ultimate decisions, the valuations and the choosing of ends, are beyond the scope of any science. Science never tells a man how he should act; it merely shows how a man must act if he wants to attain definite ends." (HA, 10)

Mr. North's continued focus on capital assets remains perplexing relative to Mises's tutelage. For example, he proclaims that "[t]here has to be an economic justification for a capital investment, and there is no economic justification of buying Bitcoins as an alternative currency." He claims bitcoin is a Ponzi scheme, the essence of which is a faith in something for nothing (which I will address later). He said this is "Ponzi scheme mania." He ignores reality and asserts bitcoin will not be used to facilitate exchange because "[n]obody is going to be getting rid of an asset that has moved from $2 to $1,000 in one year in order to buy pizzas. People want to hang onto it, refusing to sell, in the hopes that it will go to $2,000. This is the classic mark of Ponzi scheme psychology. People do not buy the investment for the benefits that the investment provides as an investment, in other words, because it is a capital asset. They buy it only because it has gone up in price."

For some unclear reason, Mr. North assumes the only valid or worthy investment is a capital asset. How is it possible to walk away from the 930-page tome Mises provides with this lack of basic understanding? Perhaps Mises was too dry and obscure. Perhaps drama would help.

There's an inspiring scene in the libertarian favorite V for Vendetta where Evey, facing her death, refuses to cooperate with (who she believes is) the government. She believes she is about to be murdered. But she understands that giving up her integrity is just as fatal. What is the price of her integrity? Her life. Her blood. Her most expensive source of currency. She is willing to pay it. Her last exertion of free will is to choose an exchange: an exchange of her life - a something - for nothing. Her death.

"Oh! That's an incorrect interpretation!" you might assert. After all, she's not exchanging her life for nothing. "To whom or what is this exchange offered?" I inquire. To herself. To her integrity. To her posterity. To humanity. To an idea. Because ideas do not die - they are bulletproof.

Yes. Exactly.

Mr. North offers us the sage advice that "[a]ny time you buy an investment, you had better have an exit strategy. There is no exit strategy for Bitcoins." Yet Mises said that "[h]uman action is purposeful action." (HA, 11) Mr. North, some of us are exchanging one value (fiat currency) for another value (bitcoin, another fiat currency) in pursuit of what we consider a more worthy value (e.g., an assertion of freedom against government tyranny). That is our purpose. Perhaps Mr. North, your focus on bitcoin as an investment is blurring your view from our actions being a possible means to an end. Perhaps you don't consider it because you judge it a poor trade; that there are better ways to assert your freedom, that there are better ways to throw-off oppressors. If so, I acknowledge you might be right. Your value judgments might be different from ours (or, at minimum, mine).

Want to hear the irony (if you haven't guess it already)? Differences in value judgments are one of the key components of a market:

"The market is not a place, a thing, or a collective entity. The market is a process, actuated by the interplay of the actions of the various individuals cooperating under the division of labor. The forces determining the-continually changing-state of the market are the value judgments of these individuals and their actions as directed by these value judgments. The state of the market at any instant is the price structure, i.e., the totality of the exchange ratios as established by the interaction of those eager to buy and those eager to sell. There is nothing inhuman or mystical with regard to the market. The market process is entirely a resultant of human actions. Every market phenomenon can be traced back to definite choices of the members of the market society." (HA, 257-258)

Ready for another irony? Differences in value judgments are also a key driver in the demand for money:

"All these factors indeed influence the demand for money and the height of the various individuals' and firms' cash holding. But they influence them only indirectly by the role they play in the considerations of people concerning the determination of the amount of cash balances they deem appropriate. What decides the matter is always the value judgments of the men concerned." (HA, 404)

In summary Mr. North, we are those who act. We are standing up for that which we choose to be. The currencies we use to trade for our ideals are our values. Dollars are a representation of those values, but so are bitcoins. In a sense, considering the evil that created the current monetary system and the evil the dollar has come to represent, bitcoins are, perhaps, more representative of our values than dollars. And, if you attempt to judge our values based on the current exchange rate, I'll provide you some inside information that would be illegal in government-controlled marketplaces: the bitcoin rate of exchange isn't even remotely close to what our values are worth. Jokingly, we'd say bitcoins are a steal.

Mises called "contentment or satisfaction that state of a human being which does not and cannot result in any action. Acting man is eager to substitute a more satisfactory state of affairs for a less satisfactory. His mind imagines conditions which suit him better, and his action aims at bringing about this desired state. The incentive that impels a man to act is always some uneasiness. A man perfectly content with the state of his affairs would have no incentive to change things. He would have neither wishes nor desires; he would be perfectly happy." (HA, 13)

Mr. North, some of us who use and invest in bitcoin - dare I say many of us - are not content. We are not satisfied. We are far beyond uneasiness. We are not happy.

Mr. North makes many generalizations concerning the value judgments of a large group. (He should tread cautiously else he might start believing macroeconomics to be valid.) For example, "the primary justification for Bitcoins among libertarians is the prediction that Bitcoins will become an alternative currency to all existing central bank currencies. Bitcoins are seen as a first-stage revolt against central bank money." Didn't Mises advise against Mr. North's behavior?

"For a social collective has no existence and reality outside of the individual members' actions... A collective whole is a particular aspect of the actions of various individuals and as such a real thing determining the course of events. It is illusory to believe that it is possible to visualize collective wholes. They are never visible... Whether this crowd is a mere gathering or a mass (in the sense in which this term is used in contemporary psychology) or an organized body or any other kind of social entity is a question which can only be answered by understanding the meaning which they themselves attach to their presence. And this meaning is always the meaning of individuals. Those who want to start the study of human action from the collective units encounter an insurmountable obstacle in the fact that an individual at the same time can belong and-with the exception of the most primitive tribesmen-really belongs to various collective entities." (HA, 42-43)

I do believe Mr. North goes too far suggesting what the primary justification among libertarians is. Relatively speaking, he can accurately say bitcoin is not yet popular. He can accurately say it isn't yet well-established. He can accurately say its reach is currently insignificant and its adoption rate low. Be that as it may, one thing is undeniable: bitcoin is already an alternative currency to existing currencies. To say otherwise is to deny reality.

Furthermore, there are certainly individuals who support bitcoin as a revolt. To them, if you'll permit me to be crude, it is a middle-finger salute to tyrannical governments everywhere. There are individuals willing to exchange dollars for bitcoins to defy, even if against all odds and even if only symbolically, government's evil nature. It is a statement and testament to values. It is a rage against an immoral group of people. An expensive price to pay? HA! We consider it dirt-cheap.

You see Mr. North, Bitcoin is a symbol, as is the act of supporting it. To paraphrase V, symbols are given power by people. Alone a symbol is meaningless but, with enough people, investing in bitcoin can change the world.

So go ahead and short our ideals Mr. North. We're buying long.

With those tenets, I believe Mr. North's contradictions and double-standards are less important. However, I do think it appropriate to call-out some of them if only to reinforce my belief that there is something deeper driving the articles. I find it hard to believe that someone of Mr. North's stature would make such problematic claims without ulterior motives. Something's fishy when a knowledgeable Austrian economist who clearly hates government makes the statement: "[i]f people are buying Bitcoins because of their alleged independence from central banks, they are ignorant of economics."

Mr. North claims anything made out of nothing cannot be considered money. (I did rather like the zinger "Federal Reserve wanna-be.") Sure enough, I cannot pay my taxes with bitcoin. I cannot go to the grocery store (yet) and purchase food with bitcoin. Yes, I can buy plenty of stuff with bitcoin. But that's immaterial to his argument. His words: "Bitcoins are not money; dollars are money."

On the other hand, dollars are made out of paper and the electronic digits Mr. North derides. How many articles, Mr. North, have you written discussing how awful fiat currencies, like dollars, are because they aren't backed by anything, other than a gun? How many? Yet, it is existing fiat currencies you indicate hold the upper-hand because bitcoins must be exchanged for an existing digit-substitute. All fiat currencies are in the form of - you guessed it - digital bits and bytes. It is dollars, primarily in their digital form, that provide the tools to control us. Isn't that what you've said? If so, how can something (existing fiat currencies) made out of nothing be considered money?

"Well, they shouldn't be," you might retort. Well, they are. You said so. "Dollars are money." So, are dollars money or aren't they? Are dollars made out of nothing or aren't they?

I think we can both agree that bitcoins, like dollars, are fiat currencies. They are tokens that cannot be used for any industrial purposes. They cannot convey a claim against anyone. But fiat money is still money. Who says so? Mises: "The only thing that catallactics has to establish is that the possibility of the existence of fiat money must be admitted." (HA, 429)

To consider something as money does not require it be backed by something like gold or silver. The term itself is immaterial; only that the human action of exchange occurs. Human choice and preference are not to be ignored. History is clear: paper money, made out of nothing, is considered money.

Mr. North claims bitcoin didn't develop out of market exchanges or the market process and, therefore, can't be considered money. Further, he claims that because bitcoin didn't arise from an unplanned, decentralized process, it can't be considered money.

Really, Mr. North. I know you're familiar with what happened at Jekyll Island in 1913. You even have a nice video here. Would you mind explaining how the political cartel you despise and so adeptly describe is characteristic of a market exchange or market process? Was their meeting unplanned? Of course, these are rhetorical questions. You called them "conspirators." That term certainly doesn't suggest decentralization or market.

You know the Federal Reserve, who controls and manipulates the dollar that you consider money, is characteristic of neither market exchanges nor market process. You know it was a planned and controlled process. And you know this is how all modern money is developed, controlled, and manipulated. So why do you only apply these standards to bitcoin?

Mr. North says bitcoins are a speculative asset. Lots of people trading solely based on short-term price fluctuations. So they are. So are derivatives. So are bonds. So are stocks. I understand it can be a very profitable business. Amazingly, currency speculation is done with currencies all over the world. Fiat currencies. Does that mean all fiat currencies, like the dollar that you consider money, are speculative assets? Isn't anything that is a tradable good or financial instrument speculative? If so, why is bitcoin as a speculative asset exclusionary? As you've written that people speculate in your favorite asset class, is gold prevented from being money?

Mind a quick tangent Mr. North? I wonder if you've ever heard of Irwin Schiff. Oh, of course you have. Silly me, I should have known you'd be on one of his mailing lists. As you undoubtedly know, after a complete farce of a trial bordering on White Rose magnitude, Mr. Schiff had all his money taken by the government because of his political beliefs. He had his money in banks. He had his money with a publisher (who was planning to send it to him). The government took it all. His money was not safe in banks. His money was not secure with another party. He is now a political prisoner.

I know you've written often how our fractional reserve system means money is not safe and secure in banks. Yet, for all intents and purposes of us common-folk, checking accounts and (if we're lucky) savings accounts house most of our financial assets. Do you consider those accounts speculative? Of course you don't. They aren't investments. Sure, we'll use them to buy food. To send our kids to school. To provide us a place to live. To pay for medical care. All of those events will happen in the future. But we can't really consider that these accounts hold investments for our future, right?

Yet, I'll remind you what you've written: "[d]igits must be in a bank account at all times." Here's the conundrum: if all our money, which is held in banks, is not safe and secure because it is at risk of government theft (like in Mr. Schiff's case), does that mean all of our money is speculative as well?

Whether or not people speculate in bitcoins does not prevent bitcoin from being money any more than it prevents your favorite asset class. Says who? Mises: "There is no such thing as a nonspeculative investment. In a changing economy action always involves speculation. Investments may be good or bad, but they are always speculative. A radical change in conditions may render bad even investments commonly considered perfectly safe." (HA, 517)

According to Mr. North, "Mises argued, as Menger had before him, that money arises out of market transactions. That which did not function as money before, now functions as money. Something that was valuable for its own sake, most likely gold or silver, becomes valuable for another purpose, namely, the facilitation of exchange. People move from barter to a monetary economy."

Yet, here we are in 2014 and, by government edict, paper money continues to be the primary medium of exchange. Surely he's not saying that Mises and Menger were wrong.

Of course he knows, as did Mises: governments hamper market transactions. Always. They developed a monopoly over money. As with everything else they do, they did it by coercion. No market transaction required.

I guess if those of us who support bitcoin were to gather guns, we could also attempt the same coup over money. But we won't. Know why? Don't strain yourself - I'll tell you and, absurdly, speak for everyone: because bitcoin means more to us than the profit we can make off exchange movements or the widgets we can buy. Money is more important to us than the commodity items we can get for it. It represents deeper values and deeper goals. (See philosophical discussion above.)

Further, come closer and I'll tell you a secret. Although some of us acknowledge bitcoin won't achieve all our goals, purchasing and exchanging bitcoins are a representation of our values and a small step on a continuous path to pursue those goals. To quote a favorite of his, we are "engage[d] in conscious actions toward chosen goals."

In fact, at one point, I thought Mr. North might understand that. He wrote: "The market value of one bitcoin has gone from about $2 to $1,000 in a year. This is not money. This commodity is not being bought for its services as money." Is it so unreasonable that there are those who might purchase bitcoins for purposes other than its services as money?

Conceptually, I know he understands something about taking smaller steps that, one hopes, will lead to larger ones. After all, wasn't it Mr. North who wrote this? It did come from his website, and included this passage:

"So let us be blunt about it: we must use the doctrine of religious liberty to gain independence for Christian schools until we train up a generation of people who know that there is no religious neutrality, no neutral law, no neutral education, and no neutral civil government. Then they will get busy in constructing a Bible-based social, political, and religious order which finally denies the religious liberty of the enemies of God. Murder, abortion, and pornography will be illegal. God's law will be enforced. It will take time. A minority religion cannot do this. Theocracy must flow from the hearts of a majority of citizens, just as compulsory education came only after most people had their children in schools of some sort."

That sure sounds like a difficult and lofty goal. He might even call it his ideal. It's understandable why he'd want to take smaller steps until a future generation is trained. Although, gaining independence from government doesn't much sound like a small step. So it goes.

Bitcoin arises out of and exists as market transactions. Lots of them. Those transactions are so common that Mr. North was impassioned to write scathing articles. Therefore, bitcoin meets even his stated criteria for money. Mises agrees: "A thing becomes money only by virtue of the fact that those exchanging commodities and services commonly use it as a medium of exchange." (HA, 780) Maybe we don't use them currently as much as dollars, but it is much more common than it used to be. It will continue as such.

I rolled my eyes when I read that "[m]oney has continuity of value. This is not intrinsic value. It is historic value."

With respect Mr. North, perhaps you need to re-read your Mises. To some, continuity is valuable. To others, not so much. I don't expect slaves valued their continuous position. I don't expect Jews, et al. wanted continuity during the Holocaust. Historically, more time has passed under slavery than freedom. In some countries, more time has been spent in fighting and war than peace. I would think you'd agree that history is a poor support structure for gauging value. What say Mises on the subject?

"If a new commodity unheard of before is offered for sale, as was, for instance, the case with radio sets a few decades ago, the only question that matters for the individual is whether or not the satisfaction that the new gadget will provide is greater than that expected from those goods he would have to renounce in order to buy the new thing. Knowledge about past prices is for the buyer merely a means to reap a consumer's surplus." (HA, 411)

In other words, historic value means little to nothing.

Mr. North wrote that the central benefit of money is its predictable purchasing power and, more specifically, the predictability of the market exchange rate that makes it money:

"Here is the Austrian school's theory of money. People buy money because it has not fallen in price. But it has also not gone up in price much, either. It is predictable. Why? Because it is held in reserve by a large number of people over a large geographical area. It has become money through tradition, through experience, and through endless numbers of exchanges on a voluntary basis. It has proven itself in the marketplace as a means of facilitating exchange, and thereby as a means of preserving value over time. This is not the characteristic feature of a Bitcoin. People are not buying it to serve as money; they are buying it because they are in the midst of a mania, and they are gambling that the number of buyers will continue upward forever."

Oh no. Did he just throw at us "I've been around longer so I'm better?" Does this even need a retort, especially from a technology-minded group? Well, gee wiz. Of course, bitcoin hasn't any tradition. It started, when? Beginning of 2009? Not a whole lot of time has passed to gain that experience and produce those endless numbers. (Do you know how hard it is for me right now to withhold from making a joke about bitcoin being based on numbers?)

I own the scholar's edition of Human Action. I love it. (And I remember paying over 3x it's current price.). Mr. North, remind me again please which page discusses that tradition is required for something to be a currency. Certainly, you couldn't have been referring to this:

"Traditionalism tries to justify its tenets by citing the success they secured in the past. Whether this assertion conforms with the facts, is another question. Research could sometimes unmask errors in the historical statements of a traditional belief. However, this did not always explode the traditional doctrine. For the core of traditionalism is not real historical facts, but an opinion about them, however mistaken, and a will to believe things to which the authority of ancient origin is attributed." (HA, 191)

Cheekiness aside, tell us Mr. North: what standard do you use to determine whether or not a currency has proven itself? How about the standard you use to determine if it has preserved its value over time? Certainly, you of all people, won't claim the dollar - which is money - has preserved its value over time. In your opinion, has the dollar proven itself? It is the primary financial tool of countless wars and devastation on innocent people. Does that prove it better? Or worse?

Mr. North indicates bitcoin cannot serve as an unregulated currency unit. He also said there "has been no challenge from Bitcoins to the reign of the dollar."

Mr. North, remember when you wrote about how Netflix knocked Blockbuster out of business, and now Netflix will not even get you back? You said that "Blockbuster was doomed by its inability to respond to competition." Just so. Of course, we both know the marketplace for videos is nothing like the marketplace for money. Governments typically don't allow competing currencies, especially the US.

In other words, he's correct on both counts, but let's be clear as to reasons. The government regulates all currencies. Heck, they regulate everything and everyone. Why should bitcoin be different? Does that mean bitcoin cannot be money? Because it would be regulated? Mises didn't make any such claim: "Mintage has long been a prerogative of the rulers of the country. However, this government activity had originally no objective other than the stamping and certifying of weights and measures." (HA, 780)

The dollar is imposed on us by force. Competition isn't allowed. Just ask Liberty Dollar. As I don't believe bitcoin was referenced in the Bible, we can assume there won't be any miracles forthcoming to help bitcoin break the government's monopoly on money. Does this mean bitcoin cannot be money?

Mr. North, by your assertions, unless something is regulated and, at the same time, a challenge to the existing government power structure, it cannot be money. Putting aside what should be an obvious contradiction, does Mises make this claim? No: "What makes a thing a medium of exchange or money is the conduct of parties to market transactions." (HA 780)

Mr. North asserts that "[b]itcoins are too volatile in price ever to serve as a currency." He wants an economic equilibrium for the price of money. He wants predictability. As differentiated from what Mises termed a "plain state of rest" (HA, 245), Mr. North wants what Mises called an "evenly rotating economic system." The problem, however, is Mises thought such a system an "imaginary construction" because it eliminates "the lapse of time and of the perpetual change in the market phenomena." Mises said there could never be such a thing "[i]n reality." He called such a state "preposterous." He called it "fictitious." He called it "absurd." He said such a system "is a world of soulless unthinking automatons; it is not a human society, it is an ant hill." (HA, 247-248) (Thinking especially about Mises's last statement, perhaps he was on the mark.)

Mr. North continues:

"Anytime that anybody tries to sell you an investment, you have to look at it on this basis: "What are the future benefits that this investment will give final consumers?" In other words, how does it serve the final consumer? If it does not serve the final consumer, then it is a Ponzi scheme.

Bitcoins cannot serve the consumer. There is nothing to consume. The only way that Bitcoins can work to the advantage of the consumer is that they provides the consumer with increased opportunities, based on Bitcoins' function as money. But the fundamental characteristic of money is its relatively stable purchasing power.

Bitcoins will never achieve this. It is a mania going up. It will be a mania coming down. It will not increase the division of labor, because people will recognize it as having been a Ponzi scheme, and they will not again buy it. They will not use it in exchange. Companies will not sell goods and services based on Bitcoins. Bitcoins have to have stable purchasing power if they are to serve as money, and they will never, ever achieve stable purchasing power."

After reminding Mr. North that, when a patient flatlines, it's not a good sign, I'm just going to leave this here:

"It is a popular fallacy to believe that perfect money should be neutral and endowed with unchanging purchasing power, and that the goal of monetary policy should be to realize this perfect money. It is easy to understand this idea as a reaction against the still more popular postulates of the inflationists. But it is an excessive reaction, it is in itself confused and contradictory, and it has worked havoc because it was strengthened by an inveterate error inherent in the thought of many philosophers and economists.

These thinkers are misled by the widespread belief that a state of rest is more perfect than one of movement. Their idea of perfection implies that no more perfect state can be thought of and consequently that every change would impair it. The best that can be said of a motion is that it is directed toward the attainment of a state of perfection in which there is rest because every further movement would lead into a less perfect state. Motion is seen as the absence of equilibrium and full satisfaction, as a manifestation of trouble and want. As far as such thoughts merely establish the fact that action aims at the removal of uneasiness and ultimately at the attainment of full satisfaction, they are well founded. But one must not forget that rest and equilibrium are not only present in a state in which perfect contentment has made people perfectly happy, but no less in a state in which, although wanting in many regards, they do not see any means of improving their condition. The absence of action is not only the result of full satisfaction; it can no less be the corollary of the inability to render things more satisfactory. It can mean hopelessness as well as contentment.

With the real universe of action and unceasing change, with the economic system which cannot be rigid, neither neutrality of money nor stability of its purchasing power are compatible. A world of the kind which the necessary requirements of neutral and stable money presuppose would be a world without action. It is therefore neither strange nor vicious that in the frame of such a changing world money is neither neutral nor stable in purchasing power. All plans to render money neutral and stable are contradictory. Money is an element of action and consequently of change." (HA, 418-419)

Some philosophical mistakes Mr. North makes, perhaps, are understandable. The economic ones are less so. But then there's this:

"The problem for the defender Bitcoins is this: we need a comprehensive system of prices. For Bitcoins to work, they must be autonomous from the fiat money pricing system of the various government currencies. In order to make a pencil, there has to be a comprehensive, universal, widely recognized Bitcoins network. It is not possible to run Bitcoins as a separate currency system unless it applies to every product, every transaction, every service that is presently priced in terms of government monetary systems. Why is this? Because the division of labor must be integrated by a single currency system. In order to make the pencil, everything must be priced in terms of Bitcoins: paint, wood, carbon, rubber, metal, and every raw material and every piece of capital equipment that was used to make the pencil."

I'm going to hazard a guess: the computer on which Mr. North typed those statements had parts from China, Japan, US, Philippines, Taiwan, and Korea. And that doesn't even include the software. Guess what? Every one of those countries has their own, separate currency. Some companies who contributed components to Mr. North's computer might have agreed to use the same currency to transact their business. Others might have chosen to require payment in their own currencies. Of course, it doesn't matter. There are currency markets that convert currencies. Just as bitcoin has.

What are the implications? If a programmer of a circuit board wanted to earn bitcoins instead of his local currency, he could hire himself out for bitcoins. If the company who hires him doesn't have bitcoins, what do they do? They do what they do with any supplier who wants to be paid in their local currency: they exchange their fiat money for bitcoins. Pretty simple. Mr. North's assertion that everything needs to be priced in terms of bitcoins is perplexing, to say the least.

I'm sorry, but I have to admit these statements by Mr. North made me snicker: "[b]itcoins rests on a religious confession of faith... This is faith in a unique god: the god known as algorithm. This god is known by his promise: "seamless transition." Quite the argument from someone so devout, don't you think? Tell me if you've already heard this one: a Jewish rabbi, Catholic priest, and a bitcoin shaman enter a bar...

I find it hard to believe that Mr. North is questioning whether a faith in an unknown god and religious conviction in purported promises made are intelligent decisions. So I think I'll just leave it at that.

I'm not sure if I'm getting tired or Mr. North's statement are getting more outlandish. For a moment, I even question if he was a libertarian:

"The Bitcoins system has no customs, courts, legally enforceable contracts, no resolution of disputes. All it has is algorithms. Yet its defenders say that the system is an extension of the free market's social order. It is in fact a denial of such an order. Its defenders think the Bitcoins markets can do without the social order that brought capitalism into existence a millennium ago. It is a classic free rider. Yet they insist that their system can replace the present capitalist order."

Putting aside that "[t]he technical and legal features of the money-substitutes do not concern catallactics" (HA, 432), bitcoin is not a governmental system Mr. North. It's an alternative to one small (but important) aspect of it. That's the point.

Don't your libertarian friends ever speak about the idea that the free market can provide all of the (moral) services the government provides, but better and cheaper? Is Walter Block not a friend of yours? He's written extensively on the topic. His articles and videos are all over mises.org and lewrockwell.com, the most read libertarian website in the world (so says the podcasts).

I'm not sure where you are reading that bitcoin defenders don't see a need (or desire) in social order. Perhaps they're statements from covert government agents infiltrating social networks. It happens, you know. Perhaps you should be reading more at lewrockwell.com.

I remember dining on Indian food with my project team many years ago. The head of our division was there. He was a retail expert and was questioning Amazon's business model, which was an online bookstore only a few years old. "I don't get it. Where is the market for people buying so many books?" I thought Amazon's concept was brilliant. A colleague of mine and I argued that books aren't the only thing Amazon could sell. If the model works, it could apply to other products. "Maybe that's what they're after," he conceded. The rest, as they say, is history.

Bitcoin is money. Bitcoin is an alternative currency. Bitcoin is a medium of exchange. Not anything I've read by Mises suggests otherwise. Like any other currency, bitcoin is valued differently by each of us. Economics is not an appropriate framework to evaluate their worth, as Mises taught: "Economics is not intent upon pronouncing value judgments. It aims at a cognition of the consequences of certain modes of acting." (HA, 242). Mr. North would do well to respect his lesson.

Victor Hugo once wrote that "[a] dry eye goes with a dead soul." Mr. North, I have an admission to make: I'm depressed. My soul is alive and it hurts. I weep for the countless victims of government oppression around the world. I cry for the millions of destroyed lives that result from the ignorant and ignoble who support such oppression (which is pretty much the vox populi). I'm horrified - HORRIFIED! - by politicians who claim to be doing things in my name and for my protection. I can't bear to even glance at the monstrous justice system. There isn't one shred of integrity left in it. My face contorts when I see the brazen hypocrisy of the progressive defenders. I silently scream at people, not just because they are disinterested, but because they are comatose. I am without hope.

But, even without hope, I cannot sit by and do nothing. I cannot, at the same time, choose to live and watch idly. Using bitcoin is one of the ways I will continue to fight them. It might make little difference. But I will continue to fight in all ways that are consistent with my values. If you own any bitcoins Mr. North, but don't value them as your articles imply, feel free to send them my way. My address is: 1NhFaUAyXoBM4TAffDw4mepZAv5H9tokkQ. To me, they represent an important ideal. If you share that ideal, I hope you will review Mises and reconsider your position. I will continue to use bitcoins in pursuit of my values. I will use them to pursue freedom for all. I will use them to pursue a world of peace.

Because, to me, money isn't all that important. The values it represents and the people who share them are.

Copyright information: If you would like to post my essay elsewhere, I give you permission to post up to the first 1,000 words if you also include a link to read the rest of the essay here. Please refrain from posting my essay in its entirety elsewhere. I will not send lawyers after you or threaten you if you do otherwise. I just ask that you respect my wishes. Thank you.

About bitcoin

Bitcoin is a peer-to-peer payment system and digital currency introduced as open source software in 2009 by pseudonymous developer Satoshi Nakamoto. It is a cryptocurrency, so-called because it uses cryptography to control the creation and transfer of money. Conventionally, the capitalized word "Bitcoin" refers to the technology and network, whereas lowercase "bitcoins" refers to the currency itself.

Bitcoins are created by a process called mining, in which participants verify and record payments in exchange for transaction fees and newly minted bitcoins. Users send and receive bitcoins using wallet software on a personal computer, mobile device, or a web application. Bitcoins can be obtained by mining or in exchange for products, services, or other currencies.

There are a ton of problems with bitcoins. 1. Most people don't know what they are. 2. You can already buy stuff you want without them. 3. The miners are very expensive - enough to keep the majority out of the market (and you can't effectively use your computer anymore because of the hash rate). 4. People generally aren't going to spend the money to express themselves for something they believe in like you are. 5. Most people are apathetic when it comes to anything outside pop culture. 6. Gary's right about a few things: the wild price swings and people buying it solely because they think it's going up in price are going to scare others away. 7. See #1. 8. See #5.

Being passionate about who you are and proud of your values is pure awesomeness. It's a strong article. There doesn't seem to be any such thing as good government anymore. Gary's probably an outlier based on the libertarian articles I see. He's the only one I've read so far who's against it. But an economic argument isn't going to get people to use bitcoins. Get Justin Bieber and Katy Perry to use them. That will make a difference.

Anymore? I think some libertarians (or, more specifically, anarcho-capitalists as coined by Murray Rothbard) have a valid argument when they suggest a coercive monopoly on the use of force is never good. Some of the primary dilemmas become who defines the good and by what standard. What you consider good for you might not be good for your neighbor. Why should a gun be the deciding factor?

Bitcoin does have issues. We cannot, nor should we, ignore the deficiencies in the tools we use. But I think we should not discount how important and useful symbols can be. Even though it continues to be essential, our money has been corrupted in so many ways. Not everyone is willing to march in protest or write letters to officials (ignoring for a moment the limited effectiveness). Bitcoins can be used by quiet dissenters on a much larger scale and for a much longer timeframe. They can be used in private, without fear of government reprimand (whereas actions like Occupy Wall Street have provided a vast list of names to the government and more than a few prison stays to protestors). Think of it similar to people who won't buy products from a certain company because they are against some policy. "Honey, I'm not buying X anymore from Y because they have terrible working conditions for their employees in Z country!" It's their own quiet dissent. They feel empowered. They take pride in their protest. Of course, not everyone does it. Maybe if more did, it would make a difference. I'm not willing to give-up.

Now, you wouldn't happen to have Justin's or Katy's phone numbers handy, would you?